Managing your money is a complex skill, especially now that you no longer have to leave the house or even pull out your wallet in order to spend money. That’s why it is more important than ever for you to track spending and stick to a budget.

The Top 6 Best Investment Software in 2017| Paid & Free Portfolio Trackers & Management Software Applications. Whether you are an individual looking for paid or free personal financial portfolio management, a professional money manager, a trader, a financial advisor, a portfolio manager, a hedge fund manager, or a broker, staying on top of investment portfolio management keeps you one step. Banktivity 7, the leading Mac personal finance app. Banktivity connects all of your bank accounts in one place so you can make smarter financial decisions.

But the old-school methods of budgeting can be far too onerous for the new Millennium. Hardly anyone wants to be carrying an old-fashioned ledger book around with them to record financial transactions.

Creating your own Excel spreadsheets sounds like the world’s worst homework assignment for some. That’s where personal finance budget software comes in. There are many different budgeting and tracking programs available to help both beginning and veteran budgeters get a solid handle on their finances.

Read our comprehensive list below to learn which program will work best for your financial situation.

Quick Links to Budget Software Reviews:

All-In-One Budget Software

- Personal Capital*

- Clarity Money**

Zero-Based Budget Software

- YNAB (You Need a Budget)*

- Proactive Budget**

Money/Budget Assistants

Other Budget Software

Budget Software Graveyard

- Change

- Hip Money

- Penny

*Most Popular

**New

All-In-One Budget Software

Personal Capital

One way to describe Personal Capital’s budgeting software is an “account aggregator.” This program allows you to track and understand every single penny in all of your financial accounts. Once you link up all of your various accounts, including your bank accounts, investments, mortgage, credit cards, and any other accounts, Personal Capital summarizes your finances and offers you basic investment guidance. More info…show

- Pros: The most comprehensive aggregate of financial information, making this ideal for those with complex finances. Basic investment guidance is a major plus.

- Cons: The program is not as customizable as some others–neither asset allocations nor spending categories are customizable.

- Cost: Free

- See our review of Personal Capital.

Learn more and get started with Personal Capital

Clarity Money

Clarity Money launched in January 2017, and was acquired by Goldman-Sachs in the spring of 2018. Though it’s still a relative newcomer to this field, it has been quite the mover and shaker.

The company’s mission is to offer a service that will both watch your back when it comes to your money choices, and help you take control of your financial life. The founders of the app believe that consumers deserve nothing less than transparency and advocacy in their financial choices. They designed Clarity Money to provide exactly that. More info…show

- Pros: Clarity Money takes care of everything within the app, which makes it easy to act on their recommendations. The app offers a fairly global look at your money, helping you cancel unnecessary recurring expenses, save more money, and understand your money habits better.

- Cons: The automatic categorization of your purchases does not allow for split categorizations.

- Fees: None. Clarity Money makes its money through the sponsored products and services suggested to users. You do not have to use any of the suggestions made to you.

- Best For: Newbie budgeters or anyone who wants their money management to be easy and all in one place.

To learn more and get started with Clarity, visit www.ClarityMoney.com.

Mint

Mint is the OG free web-based personal finance tracker launched all the way back in 2006 and has been a staple of modern money management ever since.

When you sign up with Mint, you provide the program with all of your financial accounts, including bank accounts, investments, retirement funds, credit cards, 529 accounts, and even real estate purchases. Mint allows you to see all of your financial information in a single dashboard, which also calculates your net worth. More info…show

- Pros: Mint is completely free, very user-friendly, and offers balance and spending alerts to keep your money on your mind.

- Cons: You have to manually track cash spending, some automatic expense categories are not useful/incorrect and need to be changed by the user.

- Cost: Free

Check out our full review of Mint.

To learn more and get started with Mint, visit mint.com

Quicken

Quicken is the great-granddaddy of personal finance software–it was first introduced back in 1983. Though Quicken was owned by Intuit until a few years ago, the current version, Quicken 2019, has all the familiar tools and offerings that anyone who cut their teeth on the Intuit versions are used to. More info…show

- Pros: Quicken is the most comprehensive personal finance software available. Security-conscious users can rest assured that their information is completely safe.

- Cons: The sunset provision can be extremely frustrating.

- Cost: Between $40 and $55, depending upon which specific software package you purchase. The price jumps to $105 if you get the “home and business” version.

Zero-Based Budget Software

YNAB

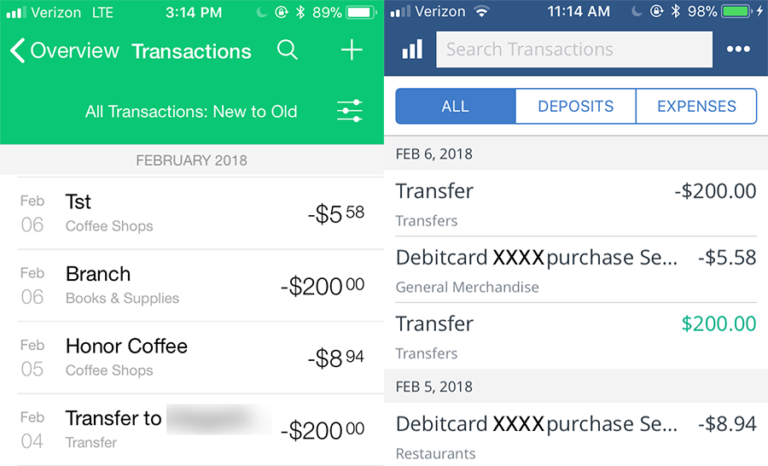

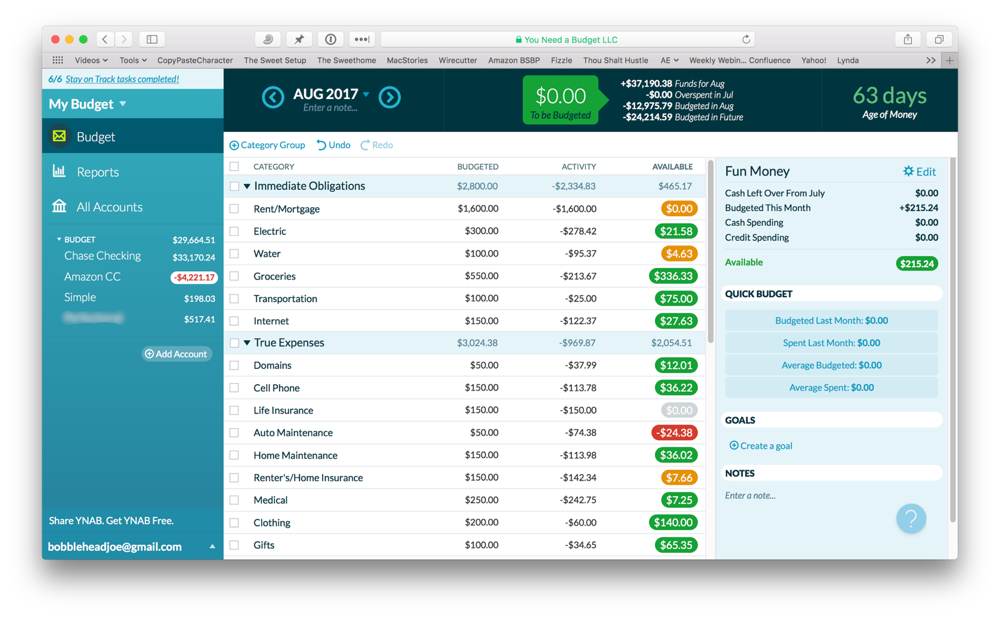

You Need A Budget (YNAB for short) is an online budgeting program based on the envelope method, wherein budgeters set money aside for specific categories of spending. The program guides you through the process of budgeting, setting goals and sticking to them, and reconciling accounts. More info…show

- Pros: YNAB is geared toward teaching users how to budget and make managing their finances a habit. The large online community can be very helpful.

- Cons: The hands-on nature of the program might not appeal to all users. The cost is higher than most other personal software.

- Cost: $84 per year

To learn more and get started with YNAB, visit youneedabudget.com

ProActive Budget

ProActive Budget is the digital version of cash envelopes.

The cash envelope method of budgeting is the age-old technique for preventing overspending. The problem is that we live in an increasingly cashless society. It can be tough to apply envelope budgeting strategies to modern methods of spending. Proactive is a forward-thinking solution. It helps you make proactive decisions before purchases versus tracking your money afterward. More info…show

Check out our full review of ProActive here.

- Pros: Like traditional envelope budgeting, you cannot make a purchase with ProActive Budget unless you know which envelope the money is coming from. That’s the brilliance with this innovation. The credit card linkup allows you to enjoy the benefits of credit while making sure you set aside the money to pay off your bill each month.

- Cons: The fact that you are unable to use your ProActive debit card if you do not have your phone available could be problematic. ProActive recommends taking a separate pay card to alleviate this concern.

- Cost: The program costs $69 per year ($5.75 per month) for the primary card. To add a companion card, it will cost an additional $29 per year ($2.42 per month), and each kid card costs $24 per year ($2 per month).

Learn more and get started with ProActive Budget. Use the code PTMONY to get a $5 discount when you subscribe.

Mvelopes

Like YNAB, Mvelopes is personal finance software that offers a 21st century method for following the envelope budgeting method. This online tool has both Android and iPhone apps that allow you to keep track of your spending on the go. More info…show

- Pros: Mvelopes is set up to be interactive in order to teach users how to budget. The credit card spending envelope feature is a very helpful aspect of the program.

- Cons: Multiple reviewers have stated that the program is not necessarily intuitive.

- Cost: $4/month or $40/year for Mvelopes Basic, $19/month or $190/year for Mvelopes Plus, $59/month or $149/quarter or $549/year for Mvelopes Complete

Check out our full review of Mvelopes.

To learn more and get started with Mvelopes, visit mvelopes.com.

EveryDollar

Dave Ramsey, the get-out-of-debt and budgeting guru, released his free online budgeting software in March of 2015. In keeping with his teachings, EveryDollar is focused on tracking every dollar. That way all of your money is accounted for and you know exactly where it is all going. According to the EveryDollar website (and borne out by multiple testers), you can create a budget on their intuitive and user-friendly online program in 10 minutes. More info…show

- Pros: The program is very easy to set up, with an intuitive user-interface and well-thought-out defaults. If you are a follower of Dave Ramsey’s teachings, EveryDollar will help you meet the goals he suggests.

- Cons: The free version of the software does not automatically add transactions, nor does it allow you to set up recurring transactions, which can cause some reconciliation headaches.

- Cost: EveryDollar basic is completely free. EveryDollar Plus costs $129 per year.

To learn more and get started with EveryDollar, visit everydollar.com.

SpendPal (Formerly Envudu)

SpendPal was designed in collaboration with Dr. Dan Ariely’s Behavioral Science Lab at Duke University. SpendPal offers another option for envelope budgeters in the cash-free world. When you sign up, the program asks you to sort the money in your checking account into separate spending Categories. You give each Category a monthly allowance and rank your Categories in order of priority. Whenever a new deposit comes into your bank account, your Categories are automatically filled in order. More info…show

- Pros: For beginning budgeters, the automatic filling of your spending categories can be an excellent introduction to money management. The fact that you can make “unverified” purchases without your phone available could be handy for the phone challenged.

- Cons: The availability of “unverified” purchases without a phone could get some users in trouble. The lack of a credit card option might turn some users off.

- Cost: Free for beta testers. There will be an unspecified monthly or yearly subscription fee once the program becomes fully available.

To learn more and get started with SpendPal, visit spendpal.com.

Money/Budget Assistants

Pluto Money

Pluto is an entirely free app is specifically geared toward helping “the Snapchat generation” get a handle on their money. Once you’ve downloaded the free Pluto app (which is currently only available for iPhone, although Android users can join a waitlist), the program will have you start by setting short- and mid-term savings goals, since having something to save for is such an important part of getting finances in order. More info…show

- Pros: The app is very user-friendly and is geared toward both helping you learn more about your money and make better decisions with your money.

- Cons: Currently, the app is only available for Apple, although an Android version is in the works.

- Cost: Free

To learn more and get started with Pluto Money, visit plutomoney.app.

Joy

Joy was created to improve your happiness by changing the way you choose to spend and save your money.

Scott Saunders, CEO of Payoff, pulled together a team of talented psychologists, neuroscientists, financial service experts, designers, and technology professionals to create an app that focuses on the psychology of people’s relationship with money. Their objective is to help people develop a positive relationship with money so they can achieve their financial goals and dreams. More info…show

- Pros: This app gives you the opportunity to improve your financial habits by asking you to think about how your spending makes you feel and by prompting you to set aside savings every day.

- Cons: The app is not currently available for Android.

- Fees: Free

- Platform: Currently, Joy is only supported on iOS platforms and they are working on launching an application for Android in the near future.

- Best For: Anyone who wants to improve their spending habits with strong support and encouragement from a coach’s feedback.

To learn more and get started with Joy, visit findjoy.com.

Pennies

Pennies is a very intuitive iPhone app that helps even the most absent-minded of spenders to stay on budget. Pennies allows you to set a number of budgets (such as monthly fun money, weekly food spending, and the like), with a start date, length of budget term, and the amount available to spend. Each time you make a purchase, you enter the amount into Pennies, which will show you the number of dollars and days remaining in that particular budget. More info…show

- Pros: This app is easy to use and offers a convenient method for tracking spending.

- Cons: Pennies only tracks one source of money, which means it might not work for individuals with more complicated finances. The app is only available for iPhone.

- Fees: $3.99 one time purchase fee.

- Best For: Beginning budgeters.

To learn more and get started with Pennies, visit getpennies.com

Other Budget Software

AccountMe

Large corporations use generally accepted accounting principles (GAAP) in their bookkeeping–so why shouldn’t individuals do the same? GAAP allows for efficient, comprehensive, and consistent accounting, which would be a boon to the average budgeter. AccountMe offers users a customizable GAAP accounting framework that allows you to view, edit, and budget your finances using the same double-entry bookkeeping as multi-national corporations. This means users will have an incredibly accurate view of their finances. More info…show

- Pros: Having a customizable GAAP accounting platform as an app on your smartphone is a major boon for anyone already familiar with GAAP.

- Cons: If you do not already know GAAP, it is not necessarily easy to learn from a smartphone app. This is only available for Apple.

- Cost: The AccountMe website is no longer functioning, although you can still download the app from the iTunes App store. It is unclear how much the app costs based on the information available on iTunes. When the website was still active, there were three levels, starting at $9.99 per month for the basic platform, $24.99 for the mid-level, and $49.99 for the highest level (nicknamed the Gordon Gekko level, which indicates the creators of AccountMe have a sense of humor).

To learn more and get started with AccountMe, visit iTunes.

Budget Software Graveyard

Change

Change (While Change is still active for current users, it is not accepting new registrations. You can enter your email to be notified when it begins accepting new users again).

The founders of Change started with a simple idea: the best way to influence people to save is to spark behavioral change. After all, consumers have 100% control over what they spend and save. Yet they do not necessarily make the best decisions for themselves. More info…show

- Pros: Change is all about teaching users to be mindful spenders, which is the kind of long-term lesson that all consumers need to learn. There is no expectation that you will completely give up the spending habits that make you happy. These concepts are based on solid research in behavioral economics.

- Cons: Change currently only supports financial institutions in the U.S.

- Fees: None

- Best for: Change’s creators are specifically targeting 25-35 year old Millennials, although anyone who is looking for more insight into their spending habits would get a lot out of this virtual financial assistant.

To learn more and sign up for notifications when they are accepting new customers, visit GoChange.co

Hip Money

Hip Money (Though the website claims that the Hip Money app is available, it cannot be found on either the iTunes store or on Google Play)

Imagine you had a financially savvy best friend who you could fold up and put in your pocket. He’d do all the calculations you’d need to figure out how to reach your goals (with his tiny pocket calculator), suggest an amount of money you could set aside every day to reach those goals. Then give you itty bitty high-fives when you saved money. More info…show

- Pros: The app is designed to help you reach your goals without asking you to sacrifice your priorities or make drastic changes to your spending habits. It’s all about making saving money easy.

- Cons: It’s not entirely clear how the program determines a safe amount for you to save each day, nor what safeguards are in place to protect you from a potential overdraft.

- Cost: Once Hip Money launches, the app will cost $18 per year.

Level

Level (Level is no longer active)

The Level Money app syncs with your bank account and determines how much will be left in that account after automatically deducting upcoming bills, recent purchases, and your savings goals. It then gives you an estimate of the amount of money that’s safe for you to spend over the next day, week, and month. More info…show

- Pros: The app makes spending decisions incredibly simple, and since it is synced with your accounts, you do not have to remember to enter in new purchases.

- Cons: Setting up the app can take some work, particularly if you have irregular income. In addition, some recent purchases can take a little time to show up in the app.

- Fees: None

- Best For: Beginning savers and/or budgeters, or those who hate dealing with money.

Cashpath

Cashpath (Cashpath is no longer active)

For the budget-averse, it can seem like handling money is about constantly juggling and never getting ahead. That’s where the free app Cashpath can help. Once you securely link the app to your bank and credit card accounts, the app uses your past transactions to predict and adjust your cash flow every day, showing your discretionary money as “Free Cash.” The program will help you split your Free Cash between Save and Spend. The app is designed to show you your money in real time. Therefore, it is able to automatically adjust your Spend amount each day in response to unexpected bills or over-spending. More info…show

- Pros: This is a gorgeous and easy-to-use interface. The program offers a simple method for on-the-go budgeting for individuals who break out in hives at the idea of a spreadsheet.

- Cons: The program is still new, and not all of the potential options are available yet.

- Cost: Free

Unsplurge

Unsplurge (Unsplurge is no longer active)

Would-be savers who would like some community encouragement will love Unsplurge. This iPhone app asks you to choose a goal and upload a picture of your goal. Once you have set your goal, it can then be shared with “Town,” which is the community platform for Unsplurge, where users can see others’ savings goals and cheer each other on. You (and Town, if you choose) will get to see your progress as you put money aside for your goal. More info…show

- Pros: Both the progress bar and the community aspect of Unsplurge can be very motivating and help you to establish a habit of saving money.

- Cons: Unsplurge does not help you budget or identify money that it is safe to put aside in savings. Also, the app is only available on the iPhone.

- Fees: None

- Best For: Those who are comfortable with budgeting but need additional motivation to save money.

Penny

Penny (Penny is no longer active)

What if you had a money-savvy friend who could look over your finances, put the information into an easy-to-read graph, and even give you financial advice? That’s the idea behind the newly released Penny 2.0. It’s the personal finance app that feels as easy as texting with a really helpful friend. More info…show

- Pros: This easy to use app takes a great deal of the intimidation out of finance. In addition, Penny’s pre-written questions allow new budgeters to know what to ask even if they would otherwise be confused.

- Cons: The pre-written questions might be annoying to a more advanced budgeter.

- Fee: None

- Best For: Beginning budgeters.

Do you have a favorite financial app? What do you love about it?

Want My Free 31-Step Money Guide*?

Subscribe for free. Get my guide *31 Days to Improve Your Financial Life, welcome series, and regular Five Things digest. Join 30,000+ other followers.

- Rating:

Summary:

With Mobile App, Alerts and A+ Functionality - Quicken is the best known personal finance software.

Quicken is the best known personal finance software. But is it the best? We put it to the test in our Quicken 2019 Review.

Quicken 2019

Pros

- Bank synching is optional

- Easy-to-use visuals

- Control over both budgeting and investment data

- Debt reduction tools built in

- Bill tracking and reminders

Cons

- Fairly expensive

- Doesn’t sync with all banks easily

- Can be overwhelming

- Not as smooth as some interfaces

Table of Contents

Here, we’ll walk through the general pros and cons of Quicken, who it’s best for, costs, new features, add-ons and a walk-through of features for Quicken 2019.

Quicken is one of the big names in the world of personal finance, partially because it’s been around for so long. Quicken was released in 1983. Its first version ran on DOS! So it’s something of a dinosaur among budgeting apps. With that said, Quicken still has a lot going for it, though it’s not the right financial management tool for everyone.

What is Quicken?

If you’ve never heard of Quicken, you may be new to the world of budgeting. As we noted above, Quicken is one of the oldest budgeting products around. And it has seriously evolved over the years. It can still be an overwhelming platform for some, but it’s become more intuitive and user-friendly, meaning it can meet the needs of detailed budgeters and basic budgeters alike.

These days, you can access Quicken through its traditional downloadable software, which is updated manually. But you can also use the product completely online.

Quicken 2019 Features

Quicken comes out with a new version each year. In 2018, the biggest new features were expanded options for Mac users, for instance. You can upgrade your older version, or you can just get started with the latest version. Here’s what you’ll find with Quicken 2019.

New Features and Costs for 2019

For 2019, Quicken’s biggest new feature is web access from any browser. This is great news for those who want to be able to manage their finances from multiple computers, since before you could only access Quicken on the computer where you actually downloaded the desktop software.

The web version of Quicken doesn’t have all of the features, but it does give you the ability to view balances and transactions, look at budgets and accounts, and check out your current investments and spending trends online. You can also navigate through the streamlined web dashboard, which includes much of the same information as the desktop version but is easier to navigate.

Other fixes and additions include:

- Multiple customer-requested bug fixes and enhancements, specifically focusing on reliability

- Faster start-up and load times for Quicken for Mac

- A better and faster user experience for managing investments

- Monthly releases that include bug fixes, so that the platform can evolve more quickly

- The ability to email reports directly from Quicken

These are Quicken’s newer features, but here’s a rundown of the basics you can expect from this well-known platform:

Home

The first tab on your Quicken interface is the Home tab. This gives you a quick summary of your current financial situation. The good news is that you can customize this screen. You can show your spending first or prioritize your investments. It’s completely up to you.

When you start up Quicken, the home screen will give you different quick-start options, as you’ll see below. You can see that Quicken wants me to set up my bills in the system. And as you’re getting started, you can use the built-in wizards to walk through these processes step by step.

The Customize button lets you choose exactly what appears on your home screen and in what order:

From the Home screen and every other screen, you’ll see the navigation bar on the top and one on the left. The bar on the left includes your current net worth at the bottom.

Spending

The second tab is where you’ll go to track your spending. Quicken will automatically break down imported transactions into categories. But you can always recategorize transactions. You can also change the categories here, depending on how your budget breaks down.

One of the nice things about this screen is that you can look at spending in different chunks. The drop-down menus at the top let you look at spending only from certain accounts, or from certain periods of time. So you can see what categories you spend on from your checking account versus your credit card, for instance.

Keep in mind that this data could be totally inaccurate as it comes in. Quicken will alert you when there are uncategorized transactions. But you may want to double-check the categories of every transaction as it imports. Sometimes Quicken just guesses wrong, which can throw your percentages way off.

Bills and Income

This is probably the feature I like best about Quicken versus other budgeting options. You can sync it up with your billers, such as Verizon or AT&T. It takes some time to sync up with all your bills. But once you do, Quicken will put them into a calendar view. Then it’ll tell you what your account balances should be based on your upcoming bills.

You can do the same thing with planned income. If you have a salaried job with regular paychecks, tell the system when you’ll get paid and how much. Again, it uses this data to project out your account balances.

If you’d rather, or if your bill provider isn’t available, you can put in your bills manually. I can, for instance, put in how much we need to pay for daycare and when that’s due each month. Again, these future bills will show up on your calendar, and you’ll get a projected account balance based on your bills.

I had to fiddle around with this interface for a bit before I could figure out how to use it properly. But once you have it, syncing up your bills shouldn’t take all that long. It’s just a matter of making sure you put them all in so that your projected balance isn’t too far off.

Once you put the bills in, you can mark them as they get paid off. This will happen automatically if you’re synced to the biller.

Financial Planning

Quicken’s robust financial planning tool includes several options, such as budgeting, tax planning, and long-term planning.

I dug into the budgeting tool with Quicken. As with the rest of the software, this wasn’t the most intuitive budget builder I’ve ever used. You have to first create the budget and then use the “Budget Actions” tab to decide which categories to add. But they offer a bunch of categories, so you can create quite a detailed budget.

Once you add the categories, you have to edit them individually to change their amounts. It’s really kind of a pain.

But here’s something I do like: you can decide at the beginning of the year how much to budget each month for each category. If you like planning way ahead, this is a great option. Not many online budgeting tools will let you plan an annual budget or plan so far into the future.

Quicken also includes on this tab is Debt Reduction calculator. This lets you keep track of your current debts and create a plan to pay them off. It helps you project out how much you need to pay towards your debts to get them paid off, and it’ll show you how much interest you can expect to pay over time.

The Savings Goals tab allows you to do the same thing except for savings. You can save for specific goals, such as an upcoming vacation or a new car. This section is meant for short- and mid-term goals. The investment tracking option is more for long-term goals like retirement and overall financial freedom.

Quicken also offers a Tax Center. You can input your tax information, and it will tell you your projected tax return or taxes due. You can also assign expenses to various tax categories. This is helpful if you’re a small business owner or if you run a side gig with tax-deductible expenses. You can also use it to track things like charitable donations.

The Lifetime Planner tool is, as you might guess, a big overview of your entire financial life. You have to first answer several questions, and then Quicken helps you project your finances out over years and decades. It’s a high-level tool that can be helpful for gaining some additional insight into your financial life.

Add-Ons

If you’re already using Quicken, you should consider adding on some of its additional services. The most worthwhile are probably the bill paying services. This service is free for Premier and above users, or it costs $9.95 per month for others. It lets you pay your bills directly through Quicken. This can just make staying on top of your bills simpler.

Other services to consider include Quicken’s Social Security Optimizer and their premium support for Windows users. There may be other tools online that can replace these, though, so be sure you do your shopping around. You can also purchase the Quicken WillMaker tool through the program. I’ve reviewed this elsewhere and think it’s a reasonable service for those with simple wills.

Other Features

Probably the best newer feature for Quicken is the ability to set up mobile accounts and get alerts. You can set up alerts for different account changes or upcoming bills, for instance. Most bank and investment accounts these days also let you set up alerts. But putting them all in one place might be helpful as you organize your financial life.

And, of course, Quicken provides lots of documentation and tutorials. It’s one of the longest-running financial management tools around. So you’d expect it to have plenty to say about how to manage your finances. In the “Tips & Tutorials” section, you can get information on Quicken, specifically, or broader information on getting out debt, setting savings goals, and more.

Quicken Pricing

A couple of years ago, Quicken moved to a membership-based pricing model. You used to be able to just buy the software from a particular year and then upgrade when you felt like it. The new model means that you automatically get updates when you renew your membership, but it also means that you have to pay each year.

In 2019, the pricing for various models of Quicken is as follows:

- Quicken Starter: $34.99

- Quicken Deluxe: $44.99

- Quicken Premier: $67.99

- Quicken Home & Business: $89.99

Editor’s note: Pricing is up-to-date as of June 20, 2019.

What’s the difference between these subscriptions? Here are the basic features each version includes:

- Starter: This is for basic budgeting and managing your bills. You can sync to your bank accounts for automated budgeting.

- Deluxe: This has everything in the Starter version, but you can completely customize your budget and manage and track your debt. You can also create savings goals.

- Premier: This version includes free online bill pay, access to priority customer support, and options to help you with your taxes and investments.

- Home & Business: If you’re a small business owner, you can use this version to track both personal and business expenses, email custom invoices with payment links from Quicken, and track your business’s profit and loss so you’re ready at tax time.

Signing Up and Getting Started

To sign up for Quicken, you just have to create an account at Quicken.com, decide which version you want to use, and download the desktop version. You’ll want to download the desktop version even if you plan to use Quicken mainly on the web. The two are synced, so having the latest desktop version ensures that everything works properly online.

Once you’re in, you can walk through each tab to set up Quicken, including syncing it with your bank accounts if you decide to do that.

Quicken’s Synchronization

Quicken actually has a couple of different types of synchronization. One is with your bank, should you choose to use it, and one is to the Quicken Cloud.

Quicken Bank Synchronization

Quicken can securely sync with your bank and investment accounts if you choose to set this up. This means it can automatically pull in balances, transactions, and investment performance. In my opinion, this is one of Quicken’s strengths. Many people are more likely to stick to budgeting each month if they don’t have to hand-enter transactions. Quicken has a couple of different ways to connect with your financial institution, outlined here.

Note, though, that you don’t have to set up Quicken to sync with your bank accounts. You can do all of the transactions manually if that’s your jam.

Quicken Cloud

The Quicken Cloud keeps your data in sync between the desktop version, Quicken Mobile, and Quicken on the web. If you want to keep your data in the desktop only, you can turn it off if you’d prefer. But it is a convenient option for ensuring you can access your financial information wherever you are.

Quicken’s Security

As with many financial products, Quicken uses bank-level 256-bit encryption to keep your data secure. It also uses multiple firewalls and checks to ensure that your data stays secure as it’s coming into Quicken. You can also decide to password protect your data files in Quicken for an additional layer of security.

Quicken for Mobile

Quicken does have a mobile app that works with Apple and Android phones. The app is similar to the web service. It gives you access to your most important financial dashboards and data. On mobile, you can store receipts via your phone’s camera and enter transactions as you spend. You can also check out your budget to ensure that you’re not over-spending when you’re out and about.

As with the desktop and web versions, the mobile app is protected by a passcode and 256-bit encryption. You can also add more protection using Face ID or Touch ID.

You can’t completely run and set up Quicken from your mobile app. But if you get everything set up on the desktop version, you can do the most essential financial data entry and management from mobile.

Customer Service and Support

Quicken offers a variety of options for customer service and support. It has a robust community where you can often find a quick answer to common questions. You can also email, call, or chat with support. They generally have decent customer support reviews, as well.

Remember, too, that when you have a Premier or higher membership, you’ll also get access to priority support.

Pros and Cons of Quicken

With a tool that’s been around since the 80’s, there’s a lot to love and a lot to dislike. Quicken definitely has its quirks, and it’s not a great fit for everyone. But it also has some great things that long-time users absolutely love. Here’s a quick list of pros and cons to consider.

Quicken Pros

- Bank synching is optional: If you don’t like the idea of a budgeting tool connecting directly with your bank accounts, Quicken doesn’t have to. It can. But you can also manually enter transactions. Or you can download a Quicken or CSV file of transactions from your bank. Then you can upload them to Quicken in just a few seconds.

- Easy-to-use visuals: I don’t find Quicken’s visuals to be the most appealing in the world of budgeting tools. But they’re not terrible. You can get a quick breakdown of where you are on your monthly budget categories, where you spend most of your money, and more.

- Control over both budgeting and investment data: Many other tools, such as Mint and Personal Capital, are more focused on either budgeting (Mint) or investing (Personal Capital). With the right version of Quicken, you can get a robust management option for both.

- Debt reduction tools built in: Trying to get out of debt? Quicken has built-in tools for reducing your debt. It will let you project out the impact of extra debt payments, including how much you’ll save in interest.

- Bill tracking and reminders: You probably already get bill reminders from many of your credit card and utilities companies. But you can move them all into the same interface with Quicken. It will also help you find your bills when you set up your account.

- Projected balances based on upcoming bills: One of the cool things about putting in your bills with Quicken is that it lets you figure out how much money you will have in the future, based on your upcoming bills.

- Automatic net worth tracking: If tracking your net worth is important to you (and it should be!), Quicken makes it easy. You’ll actually get a net worth calculation on the sidebar that updates any time you make changes or import new transactions.

- Mobile app with alerts: Quicken also offers a mobile app. It’s not the slickest one in the bunch. But it will let you enter transactions and check out your accounts on the go.

- Accessible online: This used to be listed in the “cons” section, since until recently you couldn’t access Quicken on the web. But now you can, which brings it up a notch and makes it easier to manage your financial data across devices.

Quicken Cons

- Fairly expensive: Quicken is pretty similar to Intuit’s free tool, Mint.com. It’s basically a more robust version. But it costs anywhere from $40 to $80+ per year, depending on which version you buy and whether or not you get a discount.

- Doesn’t sync with all banks easily: I had trouble syncing Quicken with my Huntington National Bank checking account. I’ve had trouble with Huntington with other tools, as well, just for full disclosure. But the problem with Quicken is that you have to purchase it before you can try to sync it with an account. So you may want to dig around online to be sure it’ll work with your bank if syncing transactions is important to you.

- Can be overwhelming: Probably the biggest issue for new Quicken users is sheer overwhelm. It includes a lot of different tools and information. Getting it set up can take a while, and learning to use it efficiently can take even longer. If you want a full picture of your finances, this can be worth your time. But if you just want to spend ten minutes a week tracking your budget, it’s probably not your best bet.

- Not as smooth as some interfaces: Quicken has always left something to be desired with its interface, I think. It’s just not as pretty or as intuitive as some budget tool interfaces. With that said, it’s gotten better since I first started reviewing it. It’s cleaner and more intuitive now than it used to be.

Alternatives to Quicken

The internet is rife with budgeting solutions at the moment. Many are cheaper and easier to use than Quicken, though they don’t often combine so many high-powered features in one product. For a full list of our alternatives to Quicken, check out this article.

Personal Financial Software

A couple of my favorites to highlight, though:

Personal Capital: This option is great for managing investments, primarily, though you can also use it for some basic budgeting. It has a great user interface and an excellent retirement planning tool.

Mint: This is bit like Quicken’s little brother. It’s made by the same company, Intuit, and it’s a free product that offers many of the same features as Quicken, including budgeting and savings goals. I like its interface and find it generally less intimidating and cumbersome to set up than Quicken.

Who is Quicken For?

Best Personal Finance Software For Mac 2018 Uk

Now that you know the basic pros and cons of Quicken, you might already have figured out whether or not it’s for you. But here are some people I think might benefit most from Quicken.

The Detail-Oriented

If you really want visibility into every aspect of your financial life all in one place, Quicken may be the best tool for you. Yes, other budget and investment tracking tools have similar functions. But few have the available tools for debt payoff, balance projections, and long-term planning that Quicken offers.

As a detail-oriented person, you may be likely to spend time digging into what Quicken offers. And this may make it worth your while. Once you get your systems in place and start using this tool, it will provide you with details on the minutiae of your entire financial life.

Business Owners

Of course, Quicken is still a go-to for business owners. Even larger businesses and nonprofits use their robust tools for managing the business budget.

But I think it’s the ideal tool for small business owners and entrepreneurs. That’s because it can simultaneously track your business finances and your personal finances. It’ll keep things separate for you, but you can use the same tool to do both. And that could save you time and headache in the long term.

Investors who Budget

As I’ve mentioned before in this review, many other tools focus on either investing or budgeting. Personal Capital is an excellent tool if you want a detailed view of your investments and a sky-level view of your spending. You can certainly use it for a more detailed budget, but it’s not built for that as much. Mint, on the other hand, will track your investments. But it gives you a detailed budget and an overview of your investments.

Best Personal Finance Software For Mac 2018 Free

Quicken combines detailed budgeting and detailed investing, so that you get both in one tool. So if you’re an investor but you also prefer to operate with a detailed budget, Quicken might be the tool for you.

Those With Security Concerns

Increasingly, budgeting and investing tools sync directly with bank and investment accounts and store data in the cloud. Quicken can be set up to do neither. It can live exclusively on your desktop. And you can pull in data manually or with downloaded transaction logs from your bank.

Financial Software For Mac Reviews

If you’re concerned about the security of other systems, Quicken can give you the financial management tools you need while allaying some of your security concerns.

Bottom Line

Quicken is an old hand at the budgeting and financial management game, and it seems to be doing a better job in the last couple of years of keeping up with its newer competitors. It does basically everything you would need a financial management tool to do, including managing both budgets and investments. With that said, it can have a steep learning curve because it is so robust, so if you don’t want to spend a lot of time managing your finances at first, you might opt for a simpler, more streamlined system.